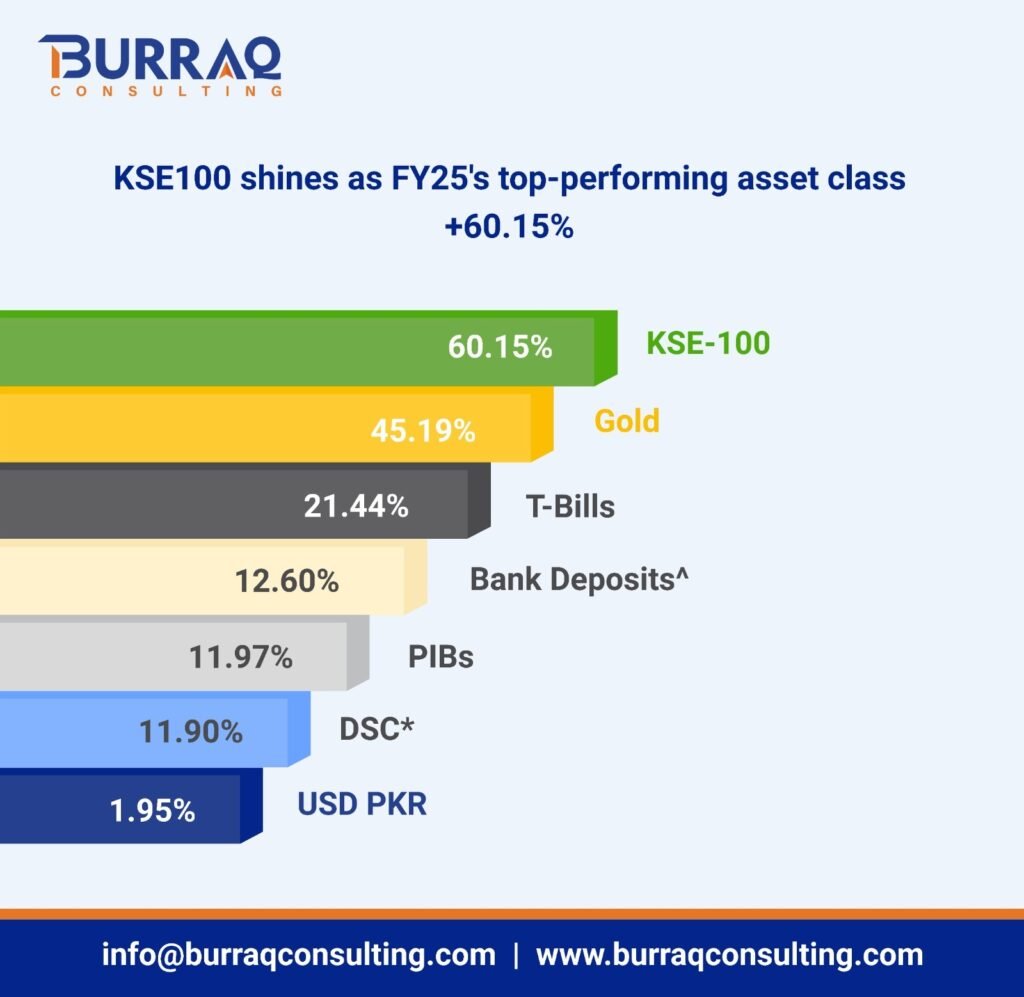

FY25 Asset Class Performance in Pakistan: KSE-100 Leads with Remarkable 60.15% Return

Title: FY25 Asset Class Performance in Pakistan: KSE-100 Leads with Remarkable 60.15% Return

As Pakistan’s economy continues to evolve amidst global uncertainties and local reforms, investors and institutions remain vigilant in assessing where their capital can generate the most value. Fiscal Year 2025 (FY25) has proven to be a remarkable year in terms of asset class performance. The standout performer this year is the KSE-100 Index, which has delivered an extraordinary return of 60.15%, outperforming all other major asset classes. This performance signals a robust recovery and renewed investor confidence in Pakistan’s equity market.

In this blog, we will explore the performance of key asset classes in FY25, analyze the macroeconomic drivers behind these figures, and discuss what this means for individual and institutional investors going forward.

- KSE-100 Index: The Equity Market Roars Back

The KSE-100 Index, the benchmark index for the Pakistan Stock Exchange (PSX), soared by 60.15% in FY25, making it the top-performing asset class of the year. This exceptional performance can be attributed to several key factors:

- Improved Macroeconomic Stability: Pakistan saw improved current account numbers, a stronger rupee, and fiscal discipline under its ongoing IMF program.

- Corporate Earnings Growth: Several listed companies reported strong earnings, particularly in the banking, cement, and energy sectors.

- Investor Sentiment: Domestic investors returned to the market with renewed optimism, while foreign portfolio investment also showed signs of recovery.

This surge not only reflects market sentiment but also showcases the resilience and potential of the Pakistani equity market when policy and economic stability align.

- Gold: The Timeless Hedge Rallies with 45.19% Return

Gold secured the second position with an impressive 45.19% return in FY25. Traditionally seen as a hedge against inflation and currency depreciation, gold maintained its value proposition in both domestic and international markets.

Key reasons behind gold’s strong performance include:

- Global Economic Uncertainty: Ongoing global geopolitical tensions and inflation in developed economies kept gold attractive.

- Rupee Weakness & Local Demand: Though the rupee stabilized, historical depreciation still pushed local gold prices upward. Additionally, the demand for gold in the wedding season and among investors looking for a safe haven remained strong.

Gold continues to play a vital role in diversified portfolios, especially in uncertain economic environments.

- Treasury Bills (T-Bills): A Safe Bet with 21.44% Yield

With a return of 21.44%, Treasury Bills maintained their position as a popular short-term investment instrument for risk-averse investors. These government-backed securities offered decent returns amid high interest rates throughout the year.

Why investors favored T-Bills:

- Monetary Tightening: With the State Bank of Pakistan (SBP) maintaining a relatively high policy rate for much of FY25, yields on T-Bills remained attractive.

- Liquidity & Safety: As a low-risk, highly liquid option, T-Bills remained the preferred choice for financial institutions and corporate treasuries.

- Bank Deposits: A Modest Yet Stable 12.60%

Bank deposit returns averaged 12.60% during FY25, reflecting the high interest rate environment maintained by SBP. While this is a lower return compared to T-Bills or equities, it remains a preferred option for individuals and businesses seeking safety and liquidity.

Depositors were able to benefit from:

- Higher Deposit Rates: Banks passed on a portion of the SBP policy rate to depositors, offering competitive returns on fixed and term deposits.

- Risk-Free Nature: For conservative investors, bank deposits remained a secure way to preserve capital.

- Pakistan Investment Bonds (PIBs): Long-Term Stability at 11.97%

PIBs offered a return of 11.97% in FY25. These long-term government bonds are favored by investors seeking steady income over a longer horizon.

Why PIBs stayed attractive:

- Long-Term Lock-In: Investors looking to lock in higher interest rates before potential monetary easing moved toward PIBs.

- Predictable Income: With coupon payments made semi-annually, PIBs continued to provide stable returns for retirement funds, insurance companies, and individuals.

- Defence Savings Certificates (DSCs): 11.90% Return

DSCs yielded 11.90% for FY25, maintaining their reputation as a safe and reliable long-term investment option backed by the government of Pakistan. While marginally lower than PIBs, DSCs remained a favored choice for retail investors due to their guaranteed returns and availability through post offices and National Savings Centers.

- USD to PKR: A Weak Return of 1.95%

Investors in foreign currency holdings saw a minimal return of 1.95% on USD/PKR exchange rate movement. This is a stark contrast to previous years, where dollar-based returns were driven by consistent rupee depreciation.

This year’s lower return suggests:

- Rupee Stabilization: Government efforts and IMF-backed reforms helped stabilize the rupee against the dollar.

- Reduced Dollar Demand: Tighter currency controls and better current account management contributed to less volatility.

While foreign currency remains an important hedge, FY25 showed that in a stable macroeconomic environment, its gains can be limited.

Comparative Analysis

| Asset Class | FY25 Return |

| KSE-100 Index | 60.15% |

| Gold | 45.19% |

| T-Bills | 21.44% |

| Bank Deposits | 12.60% |

| PIBs | 11.97% |

| DSCs | 11.90% |

| USD/PKR | 1.95% |

The above table provides a snapshot of where each asset class stood at the end of FY25. The dominance of equities is clear, followed by gold and then fixed-income instruments.

What This Means for Investors

The FY25 asset class performance tells a broader story:

- Equities Thrive in Stability: When macroeconomic indicators improve and reforms are sustained, equities can deliver outsized returns.

- Diversification is Key: Gold, T-Bills, and PIBs showed that a balanced portfolio across asset types offers safety during market shifts.

- Currency Hedge May Underperform in Stability: USD-based returns were weak, which is a positive indicator for the rupee but a caution for currency speculators.

Looking Ahead to FY26

While FY25 saw stellar returns in equities, it may be prudent to manage expectations going forward. With potential interest rate cuts, a possible shift in government policies post-election, and continued reliance on foreign funding, investors must:

- Diversify Portfolio Exposure

- Keep an Eye on Monetary Policy

- Consider Professional Financial Advice

Long-term success will depend on balancing high-growth assets like equities with secure instruments such as T-Bills, DSCs, and gold.

Conclusion

FY25 has been a year of rebound and resilience for Pakistan’s financial markets, led by the spectacular performance of the KSE-100 Index, which delivered a record-breaking 60.15% return. While other assets like gold and government securities provided stability, it was equities that stole the spotlight.

For investors, this underscores the importance of staying informed, seeking diversification, and responding dynamically to the macroeconomic landscape. With careful planning and strategic allocation, the future holds substantial promise.